The transformation and future of tourism has been a constant topic of discussion in the adventure travel industry in the last year and a half. Research has shown that domestic tourism is currently prevailing, but international travel is beginning to recover as well, and when people do begin traveling again, they expect to spend more than before. However, the other side of the story is the negative—and sometimes devastating—impact that COVID-19 has had on adventure travel providers.

To learn more about the current status of operators, the Adventure Travel Trade Association (ATTA) has completed and released its 2021 Adventure Travel Industry Snapshot Report, with data from 2020. Each year, the ATTA invites adventure industry businesses to share information about their company’s wellbeing; their guest profile; and trending consumer motivations, activities, and destinations. While the ATTA recognizes that 2020 was a difficult year for the entire travel industry, it is important to collect this data as a way to track COVID-19’s true effects. The ATTA is offering this report at no cost, to support the adventure travel community as it recovers from the pandemic.

The world was well represented in the survey respondents. Approximately half were from the Americas, with another 19% from Europe, 15% from Asia, and the remainder from other regions. Two-thirds of respondents were suppliers, 24% were buyers, and 10% were hybrid operations that both operate as buyers and suppliers in the industry.

A few key findings in this year’s report include:

- On average, trips were 36% full, and 16% of respondents had zero guests in 2020

- The average number of travelers served by respondents was 560, an 86% decrease from 3,974 in 2019

- Guides and operations were the two positions hardest hit in 2020

- 74% of respondents had over an 80% reduction in revenue compared to 2019; 45% had a 2020 gross annual revenue of less than $50,000

- Globally, 76% of respondents expect their 2021 net profit to be equal to or better than 2020

- 70% of respondents are seeing an improvement in domestic travel demand for 2021 and into 2022

- 64% of respondents are seeing an improvement in international travel demand for 2021 and into 2022

This year’s survey also asked questions about operators’ financial health and future business plans. While 36% of respondents are planning on continuing along on their current track without changes, 43% indicated that they are interested in receiving financial assistance through loans or grants, and 18% are possibly or definitely closing down. For more information about the financial impacts of COVID-19, please have a look at the recent article ATTA Industry Research Affirms 2020 Was Financially Difficult Yet Future is Cautiously Optimistic.

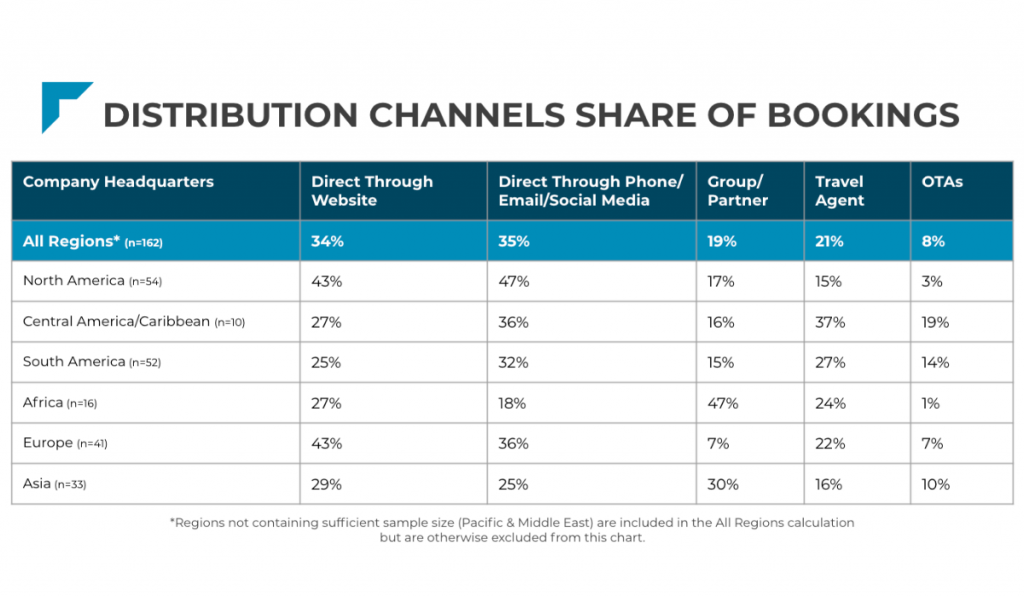

When it comes to marketing and sales, word of mouth continues to be the most helpful marketing tactic for respondents, followed by tour operator partnerships and email marketing. Globally, an average of 34% of bookings were made directly through the provider’s website, and another 35% were completed directly with the provider via phone, email, or social media. As with previous years, Facebook, Tripadvisor, and TourRadar were the most popular booking platforms used by respondents.

The most important tourism and conservation issues are climate change, wildlife protection, community livelihoods, habitat restoration, mitigating overtourism, and permanent land preservation. 40% of respondents have or are working toward a sustainability certification, an increase from 32% in the prior year.

The most important tourism and conservation issues are climate change, wildlife protection, community livelihoods, habitat restoration, mitigating overtourism, and permanent land preservation. 40% of respondents have or are working toward a sustainability certification, an increase from 32% in the prior year.

This year’s report closes with comments from ATTA CEO, Shannon Stowell:

This year’s report closes with comments from ATTA CEO, Shannon Stowell:

“There is a light shining through the fog for adventure travel. Most respondents see 2021 being better financially than 2020 with even better prospects coming in 2022 and beyond. Vaccination rates are increasing and smarter ways of dealing with the pandemic are helping the tourism industry cope. Open spaces and small groups guided by responsible operators make adventure travel more attractive than mass-market tourism, corresponding with motivations like a desire for new experiences, getting off the beaten path, and traveling like a local. We look forward to an improved 2022 for all of us.”

Download the 2021 Adventure Travel Industry Snapshot Report (data from 2020)