There is no question that 2020 was a very difficult year for the adventure travel industry. Many tour operators have indicated an interest in financial assistance through loans or grants, and more might be closing down. However, the outlook for 2021 and going into 2022 is relatively positive. Both domestic and international travel are improving (but slowly), and 2021 net profit is expected to be higher than 2020.

The ATTA has been gathering data and preparing the 2021 Adventure Tour Operator Snapshot Survey report since 2006. The goals of this report are to watch the industry’s transformation over time by monitoring trends in consumer demand and how suppliers are adapting to changes in the marketplace and global forces. Unfortunately, in 2020 the industry was given its biggest challenge in many years—COVID-19. While the ATTA recognizes that 2020 was an incredibly difficult year, it is important to collect this data as a way to track COVID-19’s effect and adventure travel’s recovery.

The world was well represented in the survey respondents. Approximately half were from the Americas, with another 19% from Europe, 15% from Asia, and the remainder from other regions. Two-thirds of respondents were suppliers, 24% were buyers, and 10% were hybrid operations that both buy and supply. The full 2021 Adventure Travel Industry Snapshot report (with data from 2020) will be released in September 2021; this article is a preview of the financial data reported by respondents.

2020 Numbers Were Poor

There is no question that 2020 was an incredibly difficult year for the entire travel industry, and adventure travel unfortunately was no exception.

- The average number of travelers served by survey respondents in 2020 was a mere 560, compared with an average of 3,974 in 2019. Sixteen percent had zero guests in 2020.

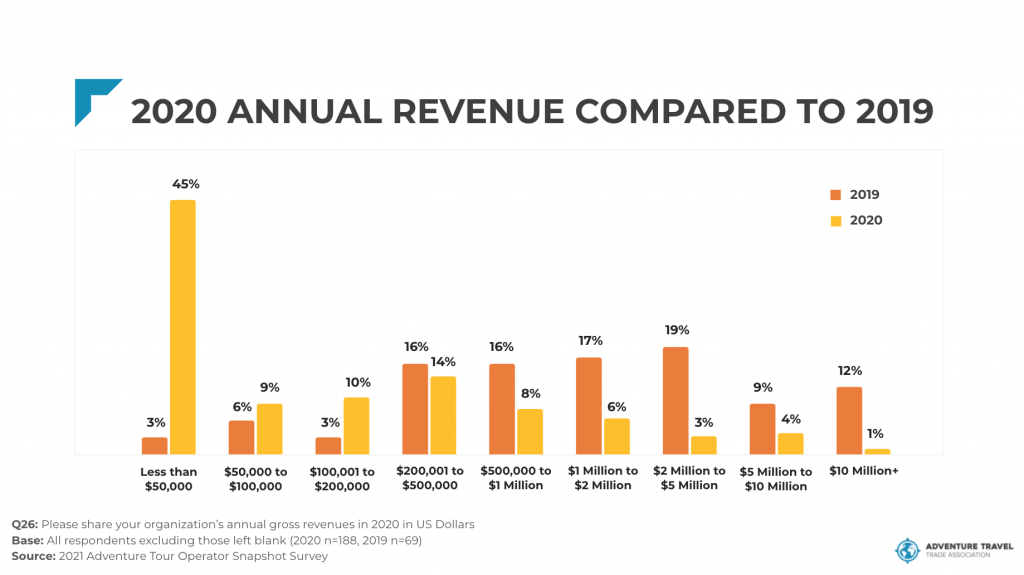

- 95% of survey respondents made less in 2020 than they did in 2019. Three-quarters of all respondents saw an over 80% reduction in revenue, and another 16% had a 50-80% reduction.

Operators Are Adapting

Tour operators have overwhelmingly made changes to their operations over the past year to respond to the way COVID-19 has affected the industry.

Outbound Buyers

- Sixty percent of respondents have changed or created new products

- Half have made reductions in the size/capacity of their business

- One third are creating more custom travel solutions

- A quarter are focusing on local, regionally-based products

- Only 15% have not made any changes to adapt to COVID-19

Inbound Suppliers

- Half have made reductions in the size/capacity of their business

- Forty percent have started marketing to local travelers

- Twelve percent have started working with more OTAs

- Only 20% have not made any changes to adapt to COVID-19

Overall, respondents are also creating new policies in their tour planning in order to protect their business or travelers’ funds. Eighty-five percent have made some kind of change; 80% have modified their cancellation polices, and 29% have modified their partner agreements. They are also increasing expenditures in some areas as a result of COVID-19: almost half have increased their marketing, 31% are improving their safety and risk management, 29% are spending more on training, and 21% are putting more money into employee retention. One third of outbound buyers and a quarter of inbound suppliers are prioritizing domestic travel over international, which aligns with the demand they are seeing in their market.

Future Outlook is Optimistically Positive

Domestic and International Travel Status

Seventy percent of respondents are seeing an improvement in domestic travel demand for 2021 and into 2022, with half saying it’s moving slowly, and another 21% saying they are beginning to be quite busy again. International travel is also rebounding, although not quite as quickly; 47% are seeing a slow return and 17% are quite busy, with the remaining 36% still waiting for an improvement.

Businesses are Looking for Financial Assistance

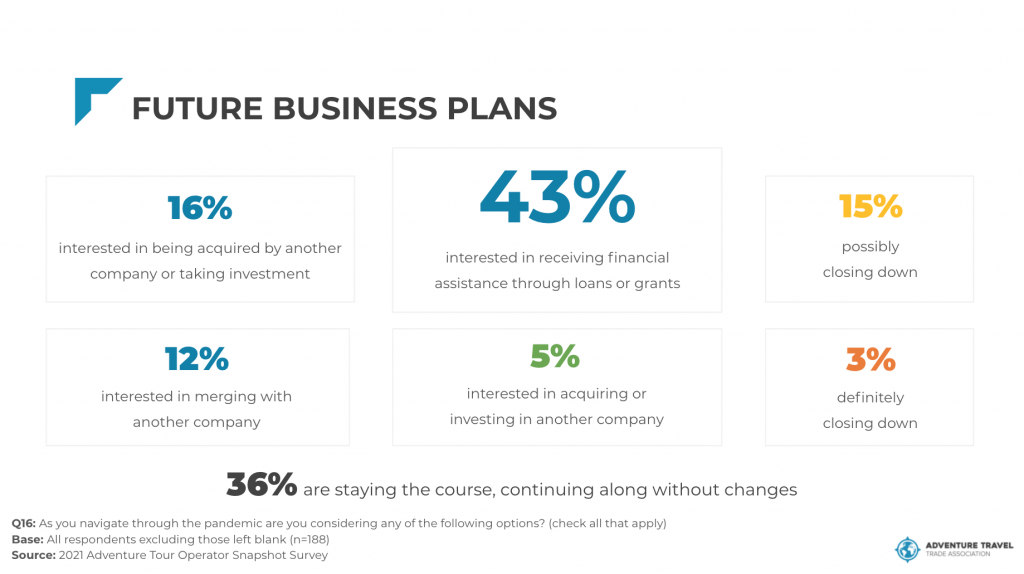

The outlook for 2021 and 2022 is becoming more positive, but businesses are still looking for financial assistance, and 18% are possibly or definitely closing down.

- 36% of respondents are financially prepared to get through the crisis

- Almost half of all responding businesses are interested in receiving financial assistance through loans or grants

- Many are interested in being acquired by or merging with another company, indicating possible financial distress

- 12% are in a position to acquire or invest in another company, signaling financial health

- Fifty-five percent of respondents indicated that their 2021 net profit is expected to be better than 2020, with 21% expecting it to be flat and 24% expecting a decrease.

Although it is clear that 2020 was a very difficult year for the industry, and 2021 is still presenting many challenges, the outlook is cautiously optimistic for the upcoming year. Adventure travel operators are adaptable by nature and have shown the same resilience to survive and emerge from the COVID-19 crisis. Look for more details on financial health, consumer trends, and more in September when the full 2021 Adventure Tour Operator Snapshot Survey report is released.